Identification information. Name, address (and previous addresses), Social Insurance Number, telephone, birth date, driver’s license, passport number, employment history. The completeness and correctness of this information may vary, depending on when and how it was provided to the credit bureaus by the companies with whom you’ve applied for credit.

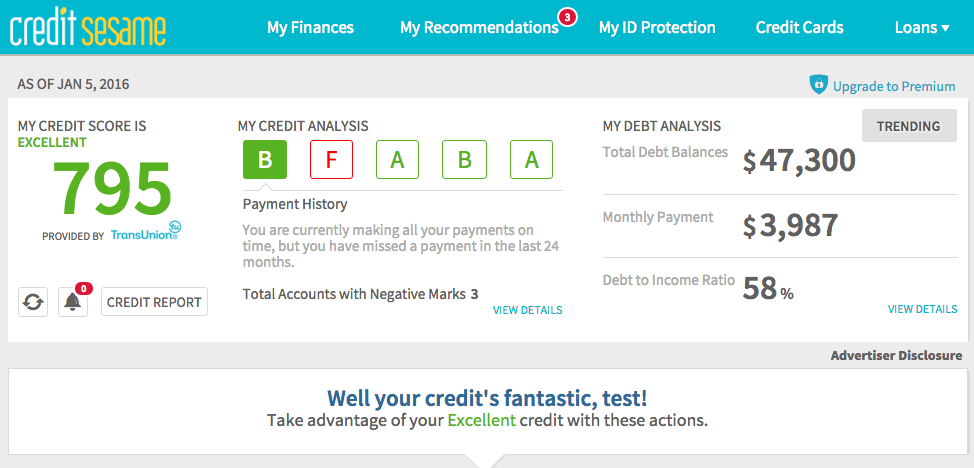

Credit history. Your credit accounts and loans with retail stores, banks, finance companies, credit unions and others. For each account the report shows balances you owe, credit limits, late and on-time payments and dates when the accounts were opened. Closed accounts are also shown. Cell phone and Internet accounts might also appear.

Public records. Judgments, bankruptcies, registered items.

Inquiries. A record of who has seen your credit report.

In short, your credit report shows lenders and other approved entities much of what they need to know in order to evaluate the risk of granting you credit. In many cases, they use a mathematical calculation to summarize important factors into a single “credit score”, but it is important to remember that all the credit scoring factors originate on your credit report, so it’s important for you keep a watchful eye on it. Free credit reports obtained by mail don’t include your credit score. To see your credit score, get your credit report online.